College Application Guide Part II: Practical Matters

We want to help you get your high schooler started with the college search process. Many students are entering their college-age years without a clear passion for what their career might be or as first-generation college students, which could put them in a position of not being as familiar with the customs of the college application process as other families might be. If that describes your child’s situation, it can be overwhelming to figure out the first step.

In the first article we sent out, we asked your student to envision themself at college and then figure out what schools out there might bring that vision to life. Then we asked your student to make a list of wants and needs regarding higher education. In Part II, we’ll talk about location and budget, two components that can make or break a college experience.

Location

Location is very important when considering what school your child wants to go to. It may seem like it isn’t a big deal for them to attend a school across the country, or even on a different continent, but prompt them to think about the cost of traveling home and what they’ll do during breaks if paying to fly home every other month isn’t part of their budget. Also ask them to consider the cost of living in the area that they are looking at and how that school handles housing for both first-year and older students.

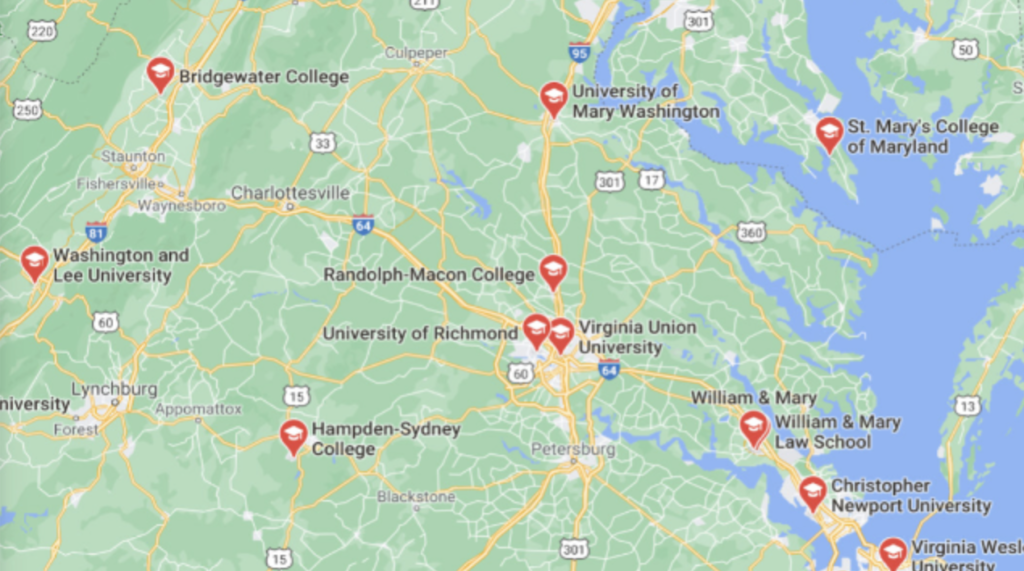

After coming up with some general descriptors of schools your student would be interested in (for example, research university, good engineering department, known for campus social life), have them search Google Maps for schools within a distance range.

They should type in relevant phrases such as “Research universities near me” or “colleges near me” and then hit enter. Some red pins will show up. Clicking on those pins will display the names of the schools near you. To expand the search, hit the minus button on the bottom left of the screen to increase the geographic range.

Here is a search for “liberal arts colleges near me” based on a location in eastern Virginia:

Then, have your student search the names of the schools within their preferred geographic area. See which ones seem to match up well with the descriptors they came up with in their thought experiment.

If you know your child will need to drive their car home every weekend to work or take care of family, they will also want to find out the policies regarding parking on campus. This little detail could make a huge difference when it comes to picking a school that works for your student. Some schools don’t allow freshmen to have a car on campus, for instance, while others allow students to purchase parking spots each semester.

Budget

The price of college is a sensitive subject. Some parents don’t talk to their kids about how much college costs because they don’t want to limit their student’s choices. On the other hand, some parents only talk about how much college costs, making it seem like attending college is an unnecessary burden.

Parents often start paying for college while their children are in school and then transfer the student loan payments over to the student upon graduation. However, this certainly isn’t the case for everyone. Some families have set aside funds to cover their children’s education expenses in full. In contrast, there is no ability, or expectation, for parents to pay for their children’s university schooling in other families.

Without transparency with your child, they could end up tens (or even hundreds!) of thousands of dollars in debt just because they never really talked about or seriously considered the cost of college, whether with you as their parent or other knowledgeable adults. And just because they can make the proposed payments that show up on an online cost calculator, that doesn’t mean that a given college is the best option for your student or that being saddled with ten, fifteen, or twenty years of loan payments is what you want for them.

Believe us when we say this: your student can receive an excellent college education at any price point; it is what they make of their time at school that matters. Taking challenging classes, volunteering on and off campus, finding local internships, and fostering meaningful relationships with their instructors are all ways they can boost the impact of their time at school no matter where they go.

There are several useful tools available to help you and your student figure out their college budget:

- The U.S. Department of Education’s Federal Student Aid site has a useful tool for figuring out how to manage one’s budget. While the site doesn’t help one figure out how much they can (or should) spend on college, it does give good advice on budgeting in general.

- Savingforcollege.com is full of information regarding how to put money away for college. The article “Calculating How Much Clients Can Afford for College” guides readers through various questions to ask about where they will get the money to pay for college upfront, and over time.

- If you are reading this early enough (say, several years from your student entering college) you might consider opening a specific college savings account, called a 529. Here is an overview of information about 529 plans from the U.S. Securities and Exchange Commission. You can then get started by searching for your state-specific 529 site.

- This nerdwallet article has some good tips for figuring out how much one can afford when it comes to college tuition, including links to understanding the cost of college and a net price calculator.

- LendingTree’s Student Loan Hero has a helpful resource regarding how much one should take out for student loans, and how much one’s repayment plan will be.

Attending Local Community College

Another great option for budgeting is for your student to start their college experience at a community college, either in person or virtually. For example, in Virginia, where the Well-Trained Mind Academy is based, students can attend two years of community college and, as long as they maintain a certain GPA, are guaranteed admission to the 4-year state school of their choice.

This kind of transfer program can save your student thousands of dollars in the cost of tuition, as well as the expenses that they might save on room and board if they continue to live at home or move to an inexpensive apartment near the school. And even if your state doesn’t have this program, starting at community college and then transferring to another institution can be a great way for your child to go to one of their favorite schools while sticking to a budget.

There is a college option out there that is right for your student!

Just remember: If your student is just starting their college search, the good news is that they will find a higher education option that is right for them. The advice we are presenting here is just the beginning. We hope these practical tips give you a good base for guiding your student’s research and help them feel in control of their college search. By showing them how to pair what they want with what they actually need, you can help give your student the best chance at finding their perfect school.